Funding Programs

Funding Programs

The 1200 Fund provides incentive, expansion support, childcare and startup loan options for businesses in multiple phases of growth within the City of Duluth. With the funding provided, businesses create new jobs, childcare availability, and the ability to bring a business continued success. Loans from the Duluth 1200 Fund are intended to address a gap in the financial package necessary to complete a project, not replace business owner equity contributions or traditional bank lending.

Loan amount: maximum of $100,000

Term of loan: Up to 17 years

Other special requirements: Provides funding for purchases, expansions for owned buildings, including equipment expenses to sustain the business. As a gap financing program, another financial institution will be required to match or exceed the amount requested from this program in addition to owner equity.

Loan forgiveness: Up to 50% of the loan principle may be forgiven after two years of the jobs that have been created have also remained available for the public. Quarterly job reporting will need to be completed to remain eligible for forgiveness.

Loan amount: $3,000 - $15,000

Term of loan: 5 - 10 Years, based on the loan amount

The Childcare Collaboration Grant provide gap financing for licensed Duluth childcare providers who are starting up or expanding within Duluth city limits.

Loan amount: Grants requests may not exceed $100,000.

Other special requirements: The 1200 Fund's assistance shall not exceed 25% of the total.

The application period for 2025 is currently closed. The Historic Fund is a yearly reoccurring program, the second round is expected open again for applications in May of 2026.

The primary purpose of the Historic Fund is to support and encourage the vitality of and reinvestment in the Duluth Commercial Historic District through preservation, improvement, restoration, and rehabilitation. Projects eligible for financial assistance include hard costs that improve the general appearance of a building’s exterior and interior commercial upgrades.

Loan amount: $75,000 - $100,000

- Buildings located outside of the priority area of East First Street are eligible for forgivable loans up to $75,000.

- 25% off the loan principle may be forgiven after 5 years if criteria is met.

- Buildings located on East First Street are eligible for forgivable loans up to $100,000.

- 50% off the loan principle may be forgiven after 5 years if criteria is met.

Term of loan: 17 Year term

Other special requirements: Building owners of contributing structures to the Downtown Historical Commercial District are encouraged to apply for funding to update building renovations. Soft costs, such the cost of project planning and consultant deliverables will be considered part of the applicant’s personal 10% match towards the requested funding. Residential tenant improvements are not eligible costs under this program.

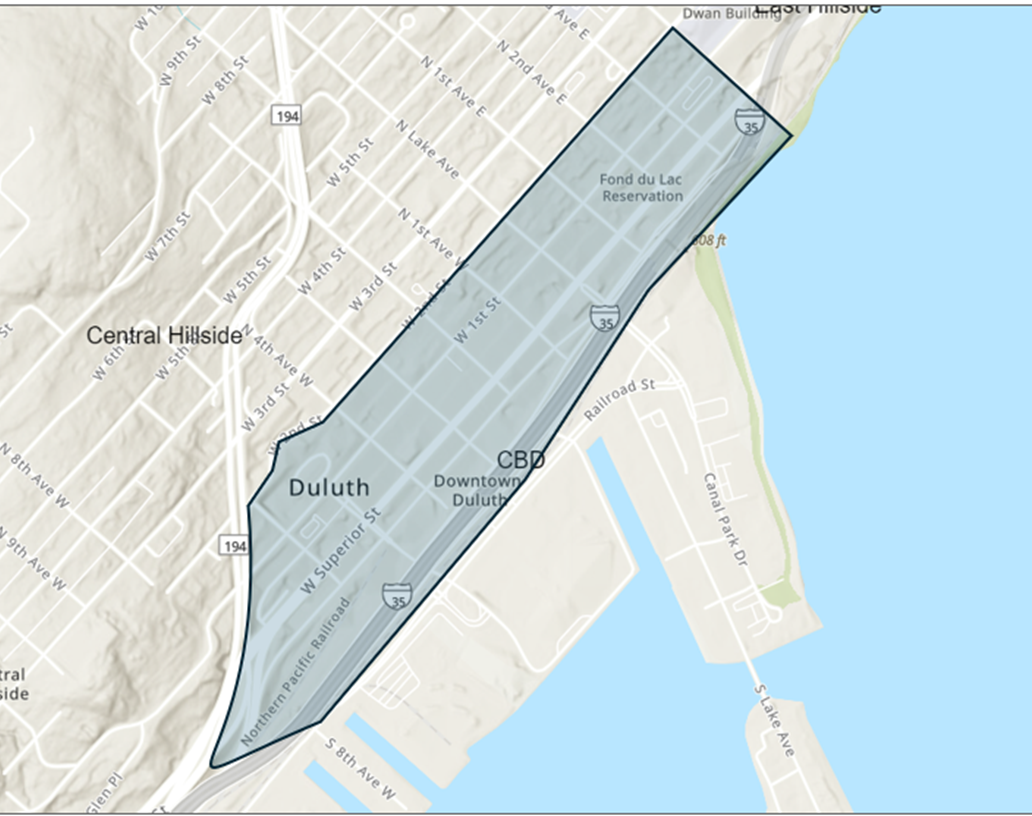

Map Containing Eligible Boundaries:

Download PDF Version of Contributing Parcel IDS

Opening for Applications Monday November 3rd, and closing for applications Monday December 15th.

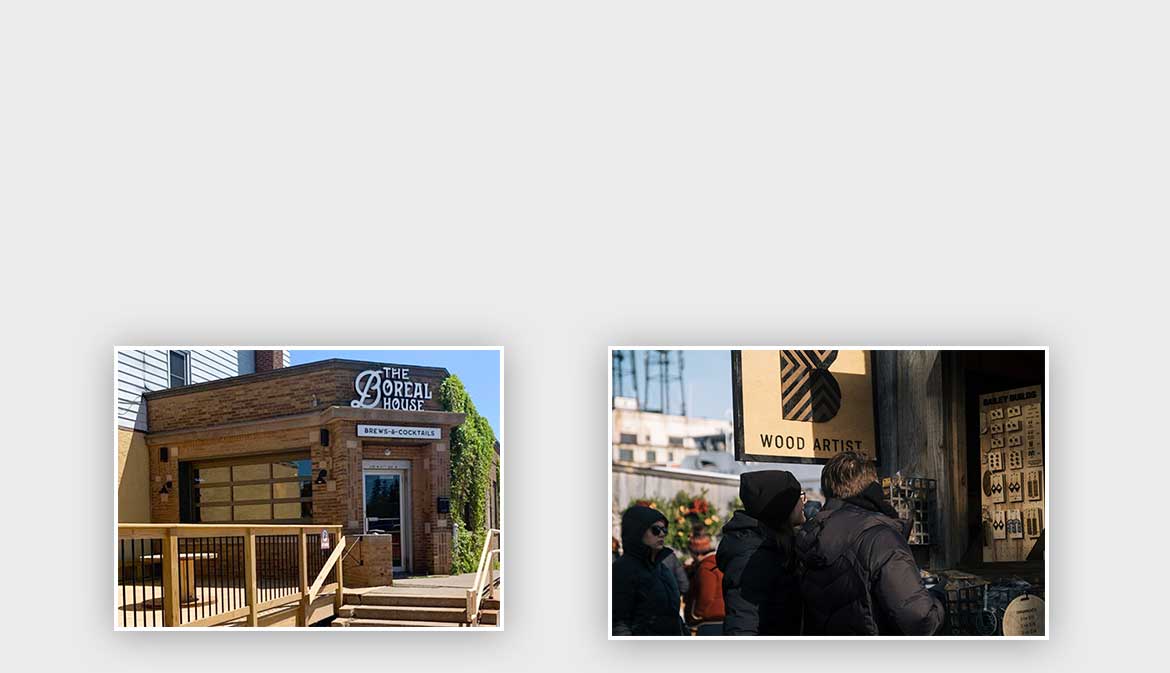

The primary purpose of the Storefront Loan Program is to encourage the reinvestment in designated Duluth neighborhood centers. Reinvestment is defined in this loan program as the restoration of historic atmosphere, overall visual improvement of building facades to strengthen neighborhoods, and enhancement of community viability within Spirit Valley and Downtown Duluth.

Loan amount: Storefront loans within each identified area are eligible for loans up to $100,000 at a fixed 4% interest rate at a term of 17 years.

Eligible uses for funding include:Projects eligible for financial assistance include hard costs that improve the general appearance of a public facing building exterior. Exterior renovations may include signage, awnings, window and door replacement, lighting, foundation repairs, tuckpointing, exterior painting, restoration of architectural elements, brick reconstruction, concrete work (outside of the city right of way), artistic murals and landscaping. The loan is not to be used for tenant improvements. Loans will be collateralized by a mortgage on the building that is being improved with the loan proceeds.

Other special requirements: Soft costs, such the cost of project planning and consultant deliverables will be considered part of the applicant’s personal 10% match towards the requested funding. Residential tenant improvements are not eligible costs under this program.

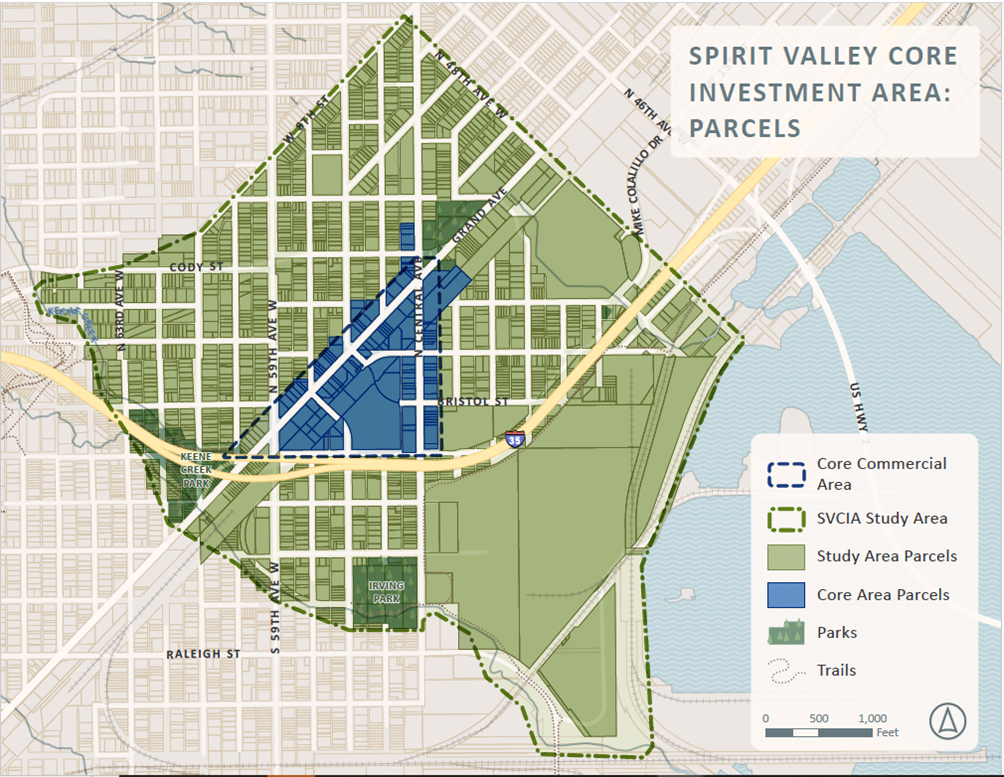

Map Containing Eligible Boundaries:

List of eligible parcels for Spirit Valley

List of eligible parcels for Downtown District

How To Apply

Is my business eligible?

If your business is located within the Duluth city limits and needs financial support to complete a project or expansion, the 1200 Fund has a loan option for you.

When is the right time to apply for a 1200 Fund loan?

The ideal time to apply is after you’ve completed a preliminary financial review with your primary lender. Once your lender has identified any funding gaps in your project, that’s when it’s most appropriate to submit your application to the 1200 Fund. This ensures we’re supporting the portion of the financing that truly needs it—complementing your primary loan package effectively.

How do I apply?

After determining the right loan program for your business needs, fill out a pre-application (available at the bottom of this webpage). A city of Duluth staff member will contact you within five business days requesting additional eligibility information.

What will be required from borrowers for a loan review?

Please see this link to get a comprehensive list of required materials that will needed to determine full eligibility. These items will be requested later, after your application is submitted and initially reviewed.

Why should I pursue a Duluth 1200 Fund loan?

The 1200 Fund board is comprised of area business leaders, skilled financial experts, business professionals and even past borrowers who believe in the non- profit’s objective to assist business and entrepreneurs. Loans are provided to fill the financial gap needed to take a project to completion, these programs can help businesses who need that final helping hand to advance their project. Some of the programs offer loan-forgiveness if certain requirements are met.

Press

The Duluth 1200 Fund celebrates 40 years of investing in the city

Northern News Now- https://www.northernnewsnow.com/video/2025/11/13/duluths-1200-fund-celebrates-40-years-investing-city/

The Duluth 1200 Fund Celebrates 40 years, press release- https://duluthmn.gov/web-subscriptions/View-press-release/?prid=8223

Tiny Step Child Care Grant

Duluth 1200 Fund Partners with Essentia Health for New Child Care Space

"We are incredibly grateful to the Duluth 1200 Fund for stepping up to invest in this vital project," said Sara Cole, President & CEO of the Duluth Area Family YMCA. "This partnership demonstrates that when our community comes together to meet urgent needs, we can create lasting impact for children, families, businesses, and neighborhoods."

Duluth 1200 Fund Launches the Historic Fund

Press Releases:

1200 Fund Announces new Historic Fund loan program-

https://duluthmn.gov/web-subscriptions/View-press-release/?prid=8076

1200 Fund’s Mentorship Loan Program now accepting applications-

https://duluthmn.gov/web-subscriptions/View-press-release/?prid=7526

Tiny Steps Press Release

https://duluthmn.gov/web-subscriptions/View-press-release/?prid=8185

1200 Fund Announces new Storefront Loan Program -

https://duluthmn.gov/web-subscriptions/View-press-release/?prid=8235

Facebook Links:

e-Bike Duluth- https://www.facebook.com/share/v/19VW8hKVwr/

Imperium Dance Company- https://www.facebook.com/share/v/1PyyoDZb8h/

Ritual Salad- https://www.facebook.com/share/v/1CfB8Ph7Hp/

Balanced Paws - https://www.facebook.com/share/v/16CzfrvmWE/

Customer Testimonials

Northland Special Events dba Josephine's Bridal

When I began planning for the build out for Josephine's Bridal, I knew I would need funding partners for the project. From the moment I reached out to the 1200 Fund to the project ribbon cutting, the 1200 exceeded my expectations. The process for applying, the collaboration with my partnering lenders, and the clear communication and expectations made the loan experience easy and stress-free. The 1200 Fund worked behind the scenes with 2 other lenders to put together a funding package that met all of my needs and required a minimum amount of time and effort on my part - think one common portal for document uploads! I loved meeting with the Board and presenting my plans, as it truly showed the community involvement of this organization. Members of the Board and staff made every effort to support the journey, including attending our grand opening and ribbon cutting. Duluth is incredibly blessed to have an organization like this to support small business and community economic development.

Mariah McKechnie, Josephine's Bridal

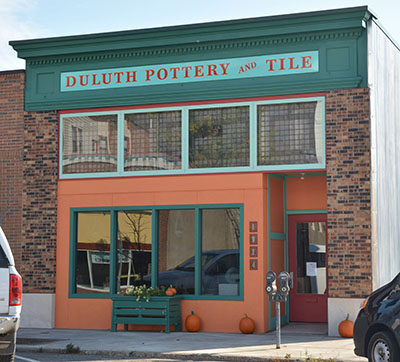

Duluth Pottery and Tile

The 1200 fund allowed the Duluth Pottery to grow by providing gap funding to put a roof on my new old building. Now we...our new team...can grow and be a solid part of the Duluth Business and work community!

Karin Kraemer, Duluth Pottery

OMC Smokehouse

The effort that goes into restoring an old building is daunting.It takes more than just finances to start up a business. It takes a team. Partnering with the city has given us the confidence to know we are all in this together. Restoring and rebuilding Lincoln Park's charm is a goal that we can all do better together. Leveraging the costs is critical in keeping the financial well being in line so we can get past the hurdles and create a vibrant tax base for long term success.

Tom Hanson, OMC Smokehouse

Contact Us

Contact Info

411 West 1st Street, Room 160

Duluth, MN 55802

218-730-5580

Board Members

- Laura Mullen (President)

- Emily Vikre (Vice-President)

- Tara Swenson (Council Representative)

- Fred Lewis

- Jebeh Edmunds

- Simone Giaacomelli

- Amber Brostorm

- Tiersa Wodash

- Michael Scharenbroich